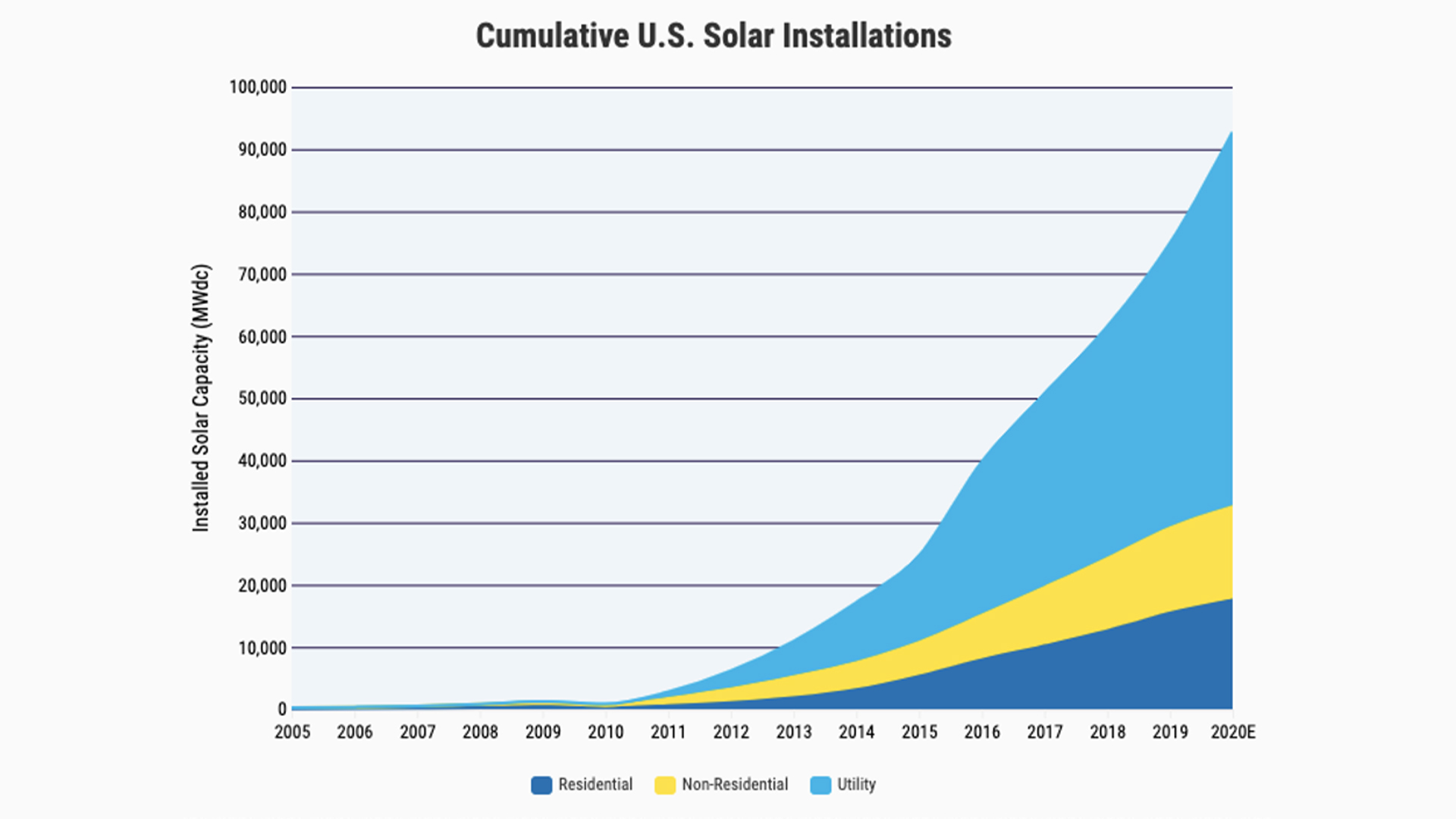

Utility-scale PV market changes happen rapidly. These shifts have accelerated over the decades, but the past decade has been particularly transformative.

One significant change is utility-scale solar power plants growing in size. 1 MW was about average for a project in North America at that time. Now average plant sizes are around 100 MW or more, some even approaching 1 GW.

This incline in project size and fast-tracked component and software innovation make risk assessment both more complicated and more valuable.

Historic stumbling blocks and current improvements

Historically, financial stakeholders in utility-scale PV have felt largely in the dark in terms of identifying and allocating risk. A decade ago, lenders and insurers reported a lack of solid understanding about the solar market themselves and doubted in developer ability to fully address their concerns.

More independent research, testing, and communication have unblocked channels to more accurate risk assessments.

Lack of consistent data on solar equipment durability

Rigorous testing of solar hardware has often been lacking in the industry. This is in part because of the disparity between controlled lab results and real-world testing.

The lack of long-term test data on real-world PV viability has also made insuring these assets more challenging. This lack of information skews the perception of solar components and installation as higher risk.

NREL released a landmark report on the challenges and solutions for insuring PV in 2010. The paper addressed an increase in financial losses in the insurance industry since 1960. Insured losses grew from almost nothing to $50 billion in 2005, and uninsured losses increased from $5 billion in 1950 to more than 70 billion in 2005.

Currently, news of continuous hurricane strikes, as well as longer and more dangerous fire seasons spreading wider across the western United States and Australia, is rampant. NOAA predicts an increase in category 4 or 5 hurricanes and more forceful winds to only increase due to climate change.

There is still insufficient information comparing the reliability of equipment from different suppliers over the 30+ year lifecycle of a modern PV solar power plant, but recent studies have shown that operations and maintenance costs can significantly effect profitability over the lifecycle of a PV solar power plant. Given this reality, lenders and insurers typically have simple approved vendor lists with all equipment on those lists considered equal in terms of reliability. We have seen numerous examples where unreliable, failure-prone equipment is on these vendor lists. This happens because there is not enough real-world data available on component failure rates.

Industry trade groups have, however, developed standard compliance practices. Model contracts, installation and O&M best practices, and the US Department of Energy’s Orange Button data standard can be used as benchmarks to navigate risk. Third-party testing is also more common and necessary to avoid siloed/bad data.

Since PV systems are subject to extreme weather, environmental tests are crucial. This has never been truer as climate change intensifies weather around the world. At ARRAY, we put our equipment to the test using both modeling and real-world scenarios utilizing assessment by 3rd party engineers to make sure we can back up durability claims.

Lack of performance data

Insuring PV sites has been a difficult task for underwriters who don’t have extensive knowledge about solar performance expectations. Since the solar industry is relatively young, data on insurance claims have also been thin.

Here again, over the past decade, industry agreement on performance and component benchmarking have created data sets for investors and insurers to evaluate risk better.

Investors are now using industry comps (traditionally used by project developers) to compare portfolio operating health and payment performance.

Component benchmarking helps identify any latent portfolio risks by reviewing sub-par equipment performance or performance trends across regions.

Industry-specific insurers

Having an insurance broker who knows the solar industry and business particulars can make the difference between paying inflated insurance premiums and getting more precise coverage at a good price.

There are even solar-specific packages covering the most common risk exposures or individual policies for certain issues, depending on the project.

Lack of standard certification

The best components installed incorrectly can be financially damaging or even dangerous. Financiers have been hesitant to back projects in some cases because of the inconsistent standards in contractors and subcontractors who build the equipment on site.

Insurers have also traditionally cited loose certification guidelines for installers as a potential weakness.

Although there are still some loose optics to certification standards, industry groups are formulating more consistency in what should be included. Working with a well–vetted EPC company with a good track record is the best way to ensure quality work.

Investors as risk managers

Investors must act as risk managers in order to satisfy the business and compliance requirements of senior business leaders, credit committees, internal and external auditors, and regulators. Doing so reduces the risk of technological and credit-related risk factors and increases project cash flow.

Trust, but verify the information coming in from asset managers. This is not to say that asset managers don’t have the knowledge or would purposefully mislead—simply that proactively working to resolve any oversights could diminish returns shortfalls.

Perhaps the most challenging part of current market assessment is the ability to calibrate the complexity of risk analysis with appropriate management. This adjustment is based on the size and type of each individual project.

While a more robust market means more standardization and better benchmarks, cookie-cutter approaches don’t apply well to solar projects. An individualized and fresh eye should be brought to every new opportunity.

Bigger projects, essential to get it right

The larger the project scale, the more incremental differences in power production over time add up to either make or break investor returns.

One of the critical attributes in mitigating the risk of reduced performance (and cash flow) is excellent design standards. Nothing can substitute for thoughtful design.

We’ll talk more about how to select and use equipment that best improves system performance in part three, “Why PV Trackers Are a Critical Component of a Risk Profile for Utility-Scale PV Solar Lenders and Insurers.”

Click here for other articles by this author